This is because not all the sales made to a particular customer are recorded in the customer’s subsidiary accounts receivable ledger. There are several types of notes receivable that arise from different economic transactions. For example, trade notes receivable result from written obligations by a firm’s customers. The tax refund fraud note has now been completely paid off, and ABC has recorded a total of $246 in interest income over a three-month period. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with…

Accounting in the Headlines

This is treated as an asset by the holder of the note, and a liability by the borrower. Overdue accounts receivable are sometimes converted into notes receivable, thereby giving the debtor more time to pay, while also sometimes including a personal guarantee by the owner of the debtor entity. The guarantee provision makes the note receivable easier to collect than a standard account receivable. When a note receivable originates from an overdue receivable, the payment tends to be relatively short – typically less than one year. To illustrate notes receivable scenarios, let’s return to Billie’s Watercraft Warehouse (BWW) as the example. BWW has a customer, Waterways Corporation, that tends to have larger purchases that require an extended payment period.

Payment of the Note

Notes Receivable due in more than one year are listed in the Long-term Asset section of the Balance Sheet. Where I/Y is interest of .75% each month (9%/12 months) for six months. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

How does Square account for the amounts it loans to small businesses?

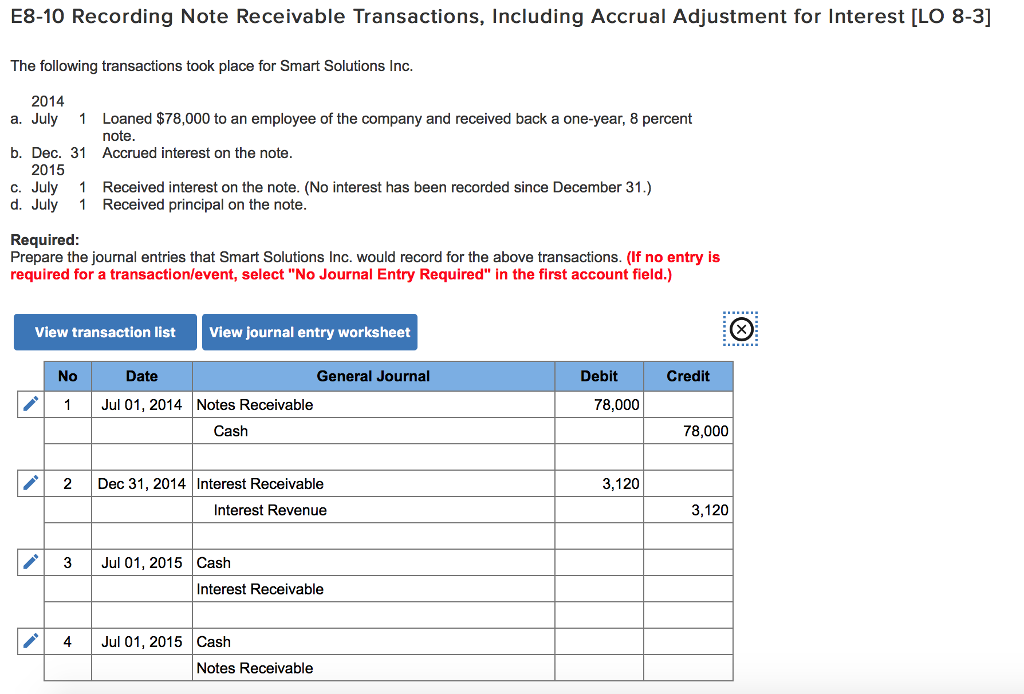

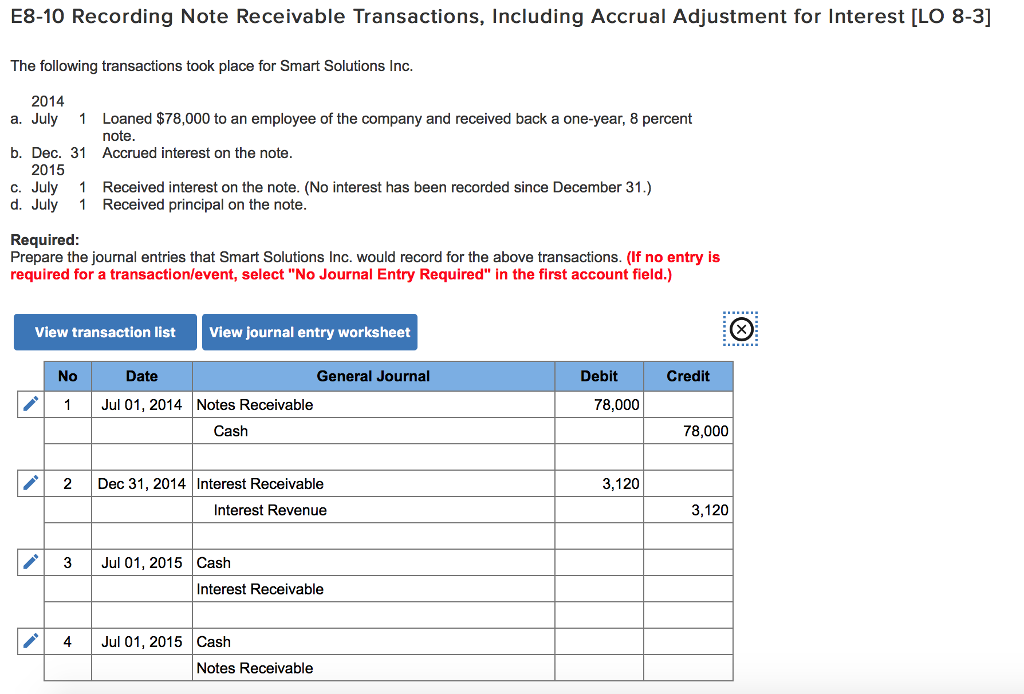

Furthermore, by transferring the note to Accounts Receivable, the remaining balance in the notes receivable general ledger contains only the amounts of notes that have not yet matured. When the payment on a note is received, Cash is debited, Note Receivables is credited, and Interest Revenue is credited. When a note is received from a customer, the Notes Receivable account is debited.

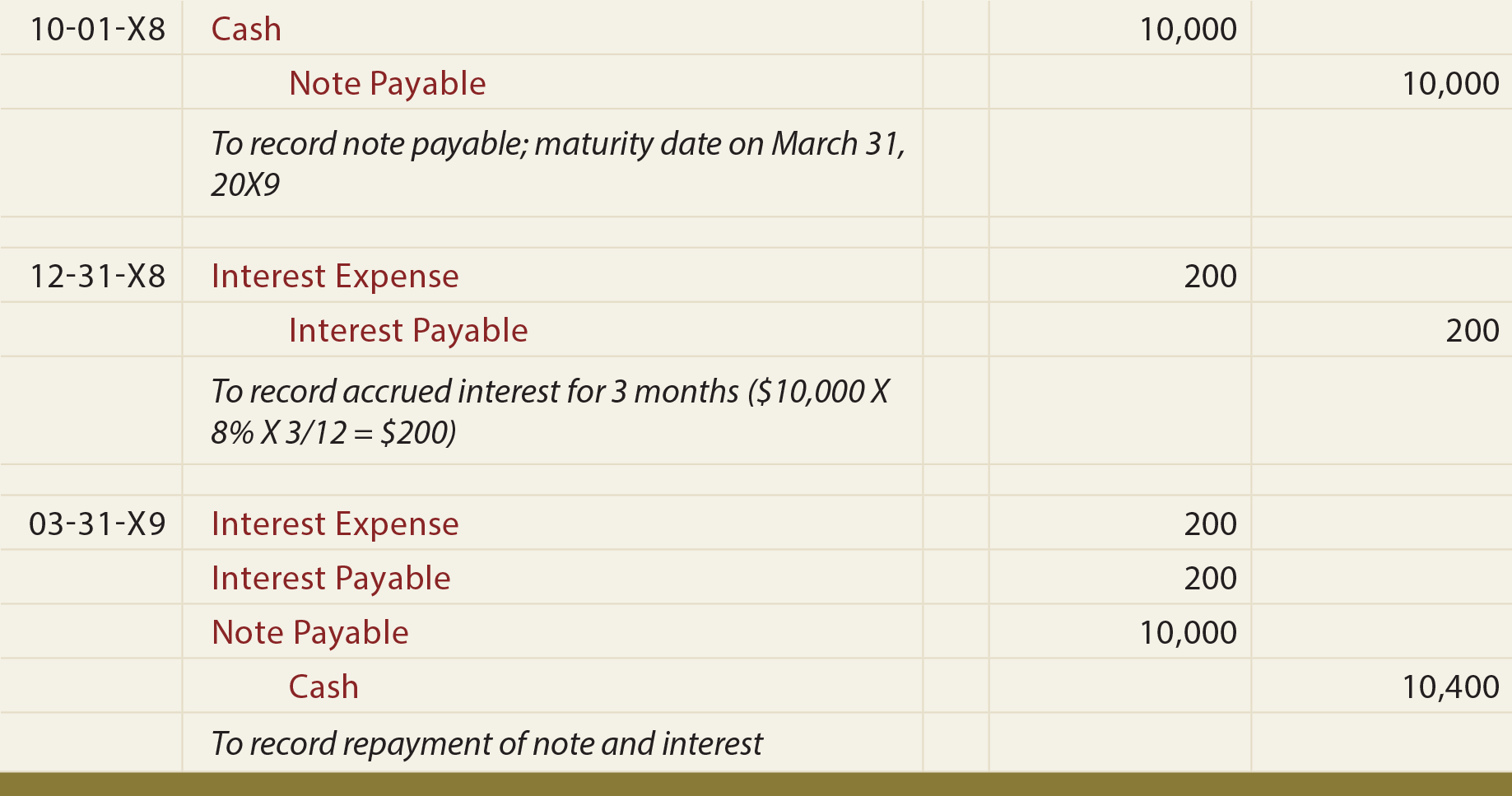

Determining present values requires an analysis of cash flows using interest rates and time lines, as illustrated next. Notes receivables describe promissory notes that represent loans paid from a company or business to another party. The note comes with a promise from the borrower that it will repay the lender in the future. For example, a company may have an outstanding account receivable in the amount of $1,000. The customer negotiates with the company on June 1 for a six-month note maturity date, 12% annual interest rate, and $250 cash up front. Dino-Kleen, a customer of Terrance Inc. owes a $10,000 invoice that is past due.

- This is the concept of the time value of money in which the present value of the note will increase bit by bit as the time passes until it reaches the end of the note maturity when the note is honored.

- In contrast, notes receivable (an asset) is a more formal legal contract between the buyer and the company, which requires a specific payment amount at a predetermined future date.

- Notes receivable can arise due to loans, advances to employees, or from higher-risk customers who need to extend the payment period of an outstanding account receivable.

Upon approval, the $7,000 is deposited into the business’s checking account the next day and then Square charges 9% of the business’s credit card sales each day until the $7,910 is fully paid. Square says that the advantage of this percentage-of-sales method is that the business does not have to make large payments when business is slow. The percentage that Square charges stays constant until the loan is paid off fully. On 1 May 20X4, PQR, Inc. lent $2 million to ABC, LLC for 2 years against a documented promissory note. DEF, Inc., another client of PQR, Inc. issued a 2-month promissory note against their outstanding balance of $3 million on 1 November 20X4.

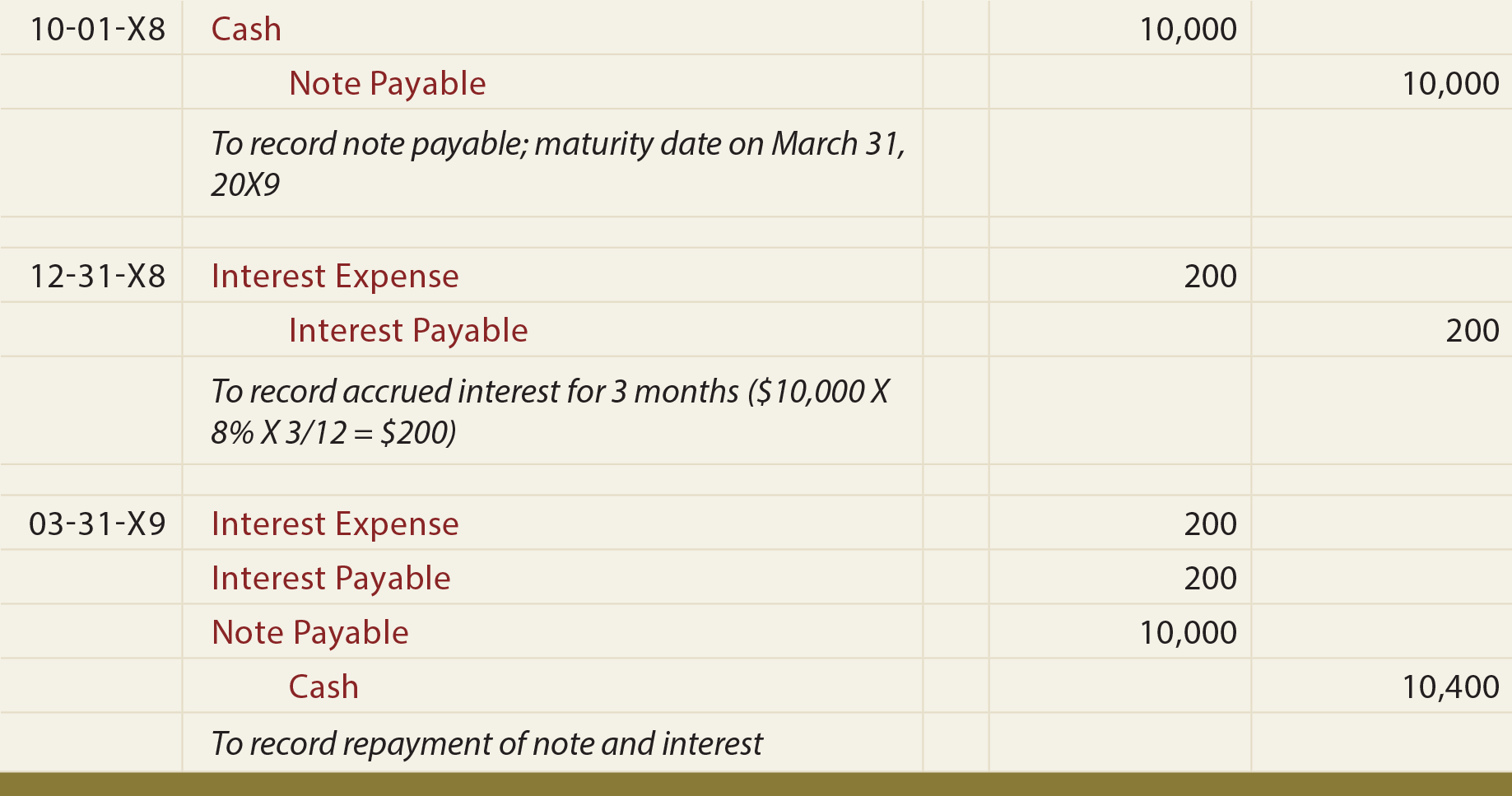

A note’s maturity date is the date at which the principal and interest become due and payable. For example, when the previously mentioned customer requested the $2,000 loan on January 1, 2018, terms of repayment included a maturity date of 24 months. This means that the loan will mature in two years, and the principal and interest are due at that time. The following journal entries occur at the note’s established start date. Notes receivables are written promissory notes which give the holder or bearer the right to receive the amount mentioned in the agreement. Sometimes accounts receivables are converted into notes receivables to allow the debtors to pay the balance.

Notes receivable can convert to accounts receivable, as illustrated, but accounts receivable can also convert to notes receivable. The transition from accounts receivable to notes receivable can occur when a customer misses a payment on a short-term credit line for products or services. In this case, the company could extend the payment period and require interest. You should classify a note receivable in the balance sheet as a current asset if it is due within 12 months or as non-current (i.e., long-term) if it is due in more than 12 months. Notes receivable are financial assets of a business which arise when other parties make a documented promise to pay a certain sum on demand or on a specific date. Notes receivable are different from accounts receivable because they are formally documented and signed by the promising party, known as the maker of the note, to the party who receives the payment, known as the payee.

If a company is selling to its customer and issuing a Note Receivable rather than an Accounts Receivable, a Revenue account would be credited to record the revenue. When interest will be paid on a Note Receivable is specified in the promissory note. The note may specify that the interest is due at the maturity of the note. Or, it may specify that interest will be due at certain points during the note’s duration (monthly, quarterly, semi-annually). Time represents the number of days (or other time period assigned) from the date of issuance of the note to the date of maturity of the note. As shown above, the note’s market rate (12%) is higher than the stated rate (10%), so the note is issued at a discount.

Let’s say that our example company turned over the $2,200 accounts receivable to a collection agency on March 5, 2019 and received only $500 for its value. The difference between $2,200 and $500 of $1,700 is the factoring expense. Interest on a note receivable is calculated by multiplying the principal balance of the note by the interest rate and by the number of days that have elapsed since the last interest payment was made divided by 365.